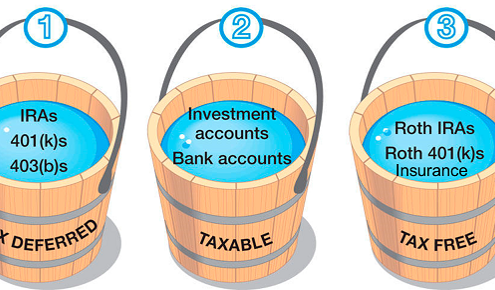

Tax Now, Tax Later or Tax Never? Which one will help you reach your retirement goals?

/

0 Comments

How to avoid a high tax bill when you withdraw money in retirement.

Maxing out retirement contributions? Do you understand the taxation when you take withdrawals?

There are huge tax consequence retirees end up paying each year on withdrawals, because people are taxed at their highest tax bracket in retirement.

Is 4.0% average growth enough to power your retirement?

Do you know how much money you’ll need to retire comfortably?

Is it time to look at some alternatives to your bond holdings?

Learn about potential substitutions for some part of your bond holdings.

Are You Living Life in Alignment with Your Core Values?

What do you value most in life? Is it family? Money? Independence?…

Creating Tax Efficient Cash Flow

How to structure your withdrawals to be as tax efficient as possible.

Five Weird Questions to Determine Life Purpose

Five Weird Questions to Determine Life Purpose

What’s your…

If Your Life Were a Business Would You Invest in It?

Think about that for a second. If your life were a business…

What’s the greatest Investment that Tony Robbins and Warren Buffett says YOU should make in YOUR life?

Warren Buffett is famous for being one of the most successful…

Tax Tips for the Individual Investor

Investors are usually quite eager to learn about the next big investment opportunity out there to increase their total portfolio return, however, they are often less enthusiastic about making an effort to minimize their tax bite. There’s money to be made by taking advantage of tax avoidance strategies. So that you don’t overlook any opportunities for improving your bottom line, here are a few simple tax principles that can help save you money.