How to Avoid Paying Taxes During the Retirement Withdrawal Phase

0 Comments

/

Many retirees overlook the cold hard reality that taxes will have to be paid on never before taxed income.

Don’t Settle for Less. How to Maximize Your Portfolio by Avoiding Taxes at Withdrawal

Learn about a simple and safe, investment vehicle that will provide you with tax-free income after retirement.

5 High Net Worth Retirement Planning Mistakes…and How to Avoid Them

Wealthy individuals may have a lot of money, but they often lack control over where it is invested – and this can cost them in the long-term.

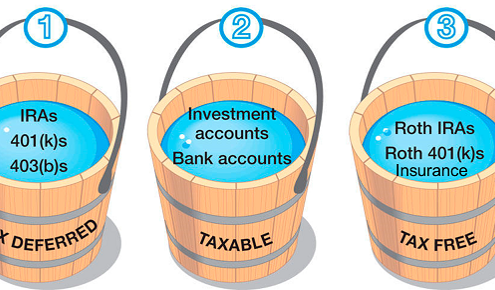

Tax Now, Tax Later or Tax Never? Which one will help you reach your retirement goals?

How to avoid a high tax bill when you withdraw money in retirement.

Maxing out retirement contributions? Do you understand the taxation when you take withdrawals?

There are huge tax consequence retirees end up paying each year on withdrawals, because people are taxed at their highest tax bracket in retirement.

Creating Tax Efficient Cash Flow

How to structure your withdrawals to be as tax efficient as possible.

Tax Tips for the Individual Investor

Investors are usually quite eager to learn about the next big investment opportunity out there to increase their total portfolio return, however, they are often less enthusiastic about making an effort to minimize their tax bite. There’s money to be made by taking advantage of tax avoidance strategies. So that you don’t overlook any opportunities for improving your bottom line, here are a few simple tax principles that can help save you money.

6 Strategies for Tax-Efficient Investing

It’s tax season again and this often prompts a variety of feelings including procrastination and intimidation. It’s no fun knowing that after factoring in federal income and capital gains taxes, the alternative minimum tax, and any applicable state and local taxes, your investments' returns in any given year may be reduced significantly.

But for some people, tax time can actually be a very happy time. That’s because they have put into place some effective strategies to decrease their income tax bite.

Here are several Strategies & Tips to potentially help lower your tax bill.

Tax Efficient Financial Planning

It’s not what you make, it’s what you keep!

This is one of the key focuses of tax efficient planning.

It’s about the bottom line, or what you actually keep after you have paid your taxes!

So, how can you plan properly and give yourself the highest probability of having a plan that will create tax efficient cash flow for you and your family for the rest of your life?