Do you know how much money you’ll need to retire comfortably?

Do you know what kind of investment return you need to get you to that amount?

Not a lot of people do the calculations – and lose money due to poor planning.

It’s not enough to just invest in your 401K and hope that you will have enough money saved up by the time you retire.

You need to determine how much money you need at retirement, and then position your portfolio to achieve the return that will move you toward that goal.

The Return was 4.06%

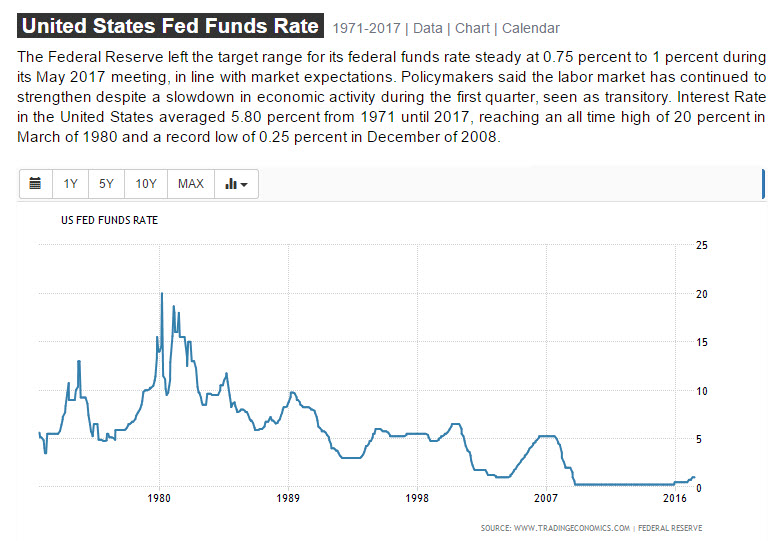

As you can see from the graphic below, there are some growth periods in which the stock market goes up 32% (like it did in 2013) and other years where it drops 37% (as it did in 2008).

Due to the volatility of the stock market, the historical average from 2000 to 2015 ends up being a measly 4.06% for an investor who started with $100,000.

Durham, NC Financial Advisor

1Sources: Yahoo! Finance GSPC Historical Prices and StandardAndPoors.com. This historical performance of the S&P 500® is not intended as an indication of its future performance and is not guaranteed.

But, the Return is Actually EVEN LESS THAN 4%

To make matters worse, it is actually less than 4.0% because you have to subtract the 1½ % to 2% a year in expenses for your 401(k) or IRA, and subtract the tax you pay on the gains or the income if taken from your retirement account or IRA.

So if you are the guy or gal in this scenario, it’s possible you’ve netted fairly little this century.

What’s the Solution? 2

One potential solution is an investment that participates in an up market, and at the same time protects you from market losses

Well how does that work you might ask!!!

Do You Want to Find Out if This Is Right for You?

If you would like to get more information on this type of investment plan please fill out the form which is linked below so I can share more information with you. 2

2Integrated Life and Financial Planning does not offer legal or tax advice. This material is not intended to replace the advice of a qualified tax advisor or attorney. Please consult legal or tax professionals for specific information regarding your individual situation.

“No theory, strategy or Asset Allocation assures success or protects against loss. This material is for general information only and is not intended to provide specific advice or recommendations for any individual. To determine what appropriate for you, consult a qualified professional.”