Creating Tax-Efficient Cash Flow.

OK, what is tax-efficient cash flow you ask?

If you are retired and are receiving annual cash flow from various sources, it is incredibly important that you have a solid plan (ideally created with your trusted financial advisor) to determine how to structure your withdrawals to be as tax efficient as possible.

In plain English that means:

Pay the least amount of tax allowed by law on the combination of income you are taking from various sources.

If we were to add up all your income for the year, and divide that income by the taxes you pay, that would give us your “average tax rate”.

You can see an example below.

If you are familiar with taxes, you might be thinking….

“Hmmmm Jerry, that 15.91% average tax rate is pretty low for that level of income! How did you do that?”

Then you are paying attention, and asking the correct questions!!

This type of planning can be overlooked by some advisors and folks who are doing this on their own. —–

Do you have a plan in place to organize your cash flow sources and amounts taken to be as tax efficient as possible?

Taking the time to plan this approach to cash flow management has the potential to save thousands of dollars a year.

What you need to do is plan properly so that your income mix is arranged for a tax efficient average tax.

For example, let’s pretend for illustrative purposes that these are your income sources for last year. You will see from the table below how each source gets taxed differently:

(If you would prefer to watch this explanation in a video format, you can click this link and watch and listen to the explanation

Income Sources & Level of Taxation:

Clearly, the Roth withdrawal is the most tax advantageous at zero percent.

Capital gains can also be very tax-efficient.

In working with clients, they are often surprised when I say this.

(People tend to hate capital gains….. Think about that for a second)

1. A capital gain means you made money!

2. You invested in something and the value went up!

3. (That is the goal, right?)

How to Calculate Capital Gains

In the scenario above, you have $30,000 that comes from selling of investments that contained a capital gain.

Let me show you how to think about this in the realm of creating cash flow.

First take a look at the illustration below.

You will note that your portfolio of $780,000 is broken into two parts (gain and original amount invested).

· In this case the original amount invested was $546,000.

· The current value of the portfolio is now $780,000.

o You see that 70% represents your own money that you invested,

o The 30% represents your gain, $ 234,000

To calculate your capital gains tax after selling the shares, you need to take these steps:

· What is the total value of the investment that you sold?

a. In our example $ 30,000.00.

· What is the cost (or your amount invested) of the investment sold?

a. In our example 70% x $ 30,000 or $ 21,000.00

· Determined profit (or capital gain),

a. In our example this is 30% or $ 9,000.00

(If all these calculations, charts and graphs, percentages and tax rates make your eyes cross and your head spin, you can just skip to the bottom and click the link to set a time to talk with me. I can then do all the math for YOU!)

Many people stop here and calculate the capital gains tax on the $30,000, but this is incorrect!

4. The fourth step is to slice the $30,000 into the same two parts: 30% as the gain ($9,000), and 70% as your original money ($21,000). You only have to pay taxes on the slice that is your gain.

Capital gains taxes in this example would look like this:

So the tax bill on the $30,000 is $1,350 (or 4.50%). This is an amazingly low tax percent that you really won’t find on any other investment other than a completely tax-free vehicle. (Or a gift from your Rich Uncle!)

Here is a current Capital Gains Chart:

http://www.moneychimp.com/features/capgain.htm

In our example the total income we are using is $ 135,000.

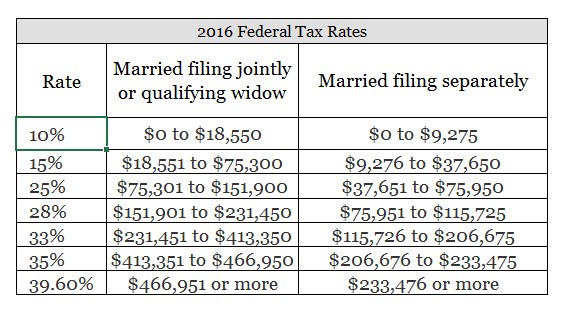

This would place our hypothetical taxpayer in the 25% ordinary income bracket for a married couple. Here is that chart:

Source: http://www.bankrate.com/finance/taxes/tax-brackets.aspx

Income Sources & Level of Taxation:

Now, with this new information in mind, let’s review our hypothetical cash flow example and see how it all works…

This is summary of your Income and Taxes. You see that the average tax on income ended up being 15.81%, and total amount paid at $21,450.

Keeping an eye on how taxes can affect your investments and your withdrawals is one of the easiest ways you can enhance your returns over time.

Have Your Financial Planner Create a Year-By-Year Plan for You

I work closely with my clients to show them ways that we can manage their portfolio to minimize their tax burden by choosing the right income sources to withdraw from.

The goal is to give you the result of a lower average tax bracket!

You can now see the value in working through a plan to set up where you will take cash flow each year. (Of course, this plan will need to be reviewed and adjusted on a regular basis).

If you have any extra unforeseen expenses throughout the year, we can actively choose the most tax-efficient withdrawal method.

If you would like to have a financial planning strategy session with me to talk about structuring your tax-efficient year-by-year withdrawals, please book a time in my calendar.

If you have read all the way to the end of this article I salute you! Nice work!!

(If you would like to watch this explanation in a video format, you can click the video screen below and watch and listen to the explanation

Jerry Bergner, AAMS CMFC

This information is general in nature and is not meant as tax advice. Always consult a qualified tax advisor for information as to how taxes may affect your particular situation.

Located in Durham, NC, Integrated Life and Financial Planning is an independent financial services firm founded by Jerry Bergner, AAMS CMFC. As a Durham, NC, Financial Planner, Jerry’s mission is to help you work toward the life YOU envision for yourself and those you care about. If you need help in clarifying that vision, he can work with you on that as well! Book a consultation meeting today.