What to do 10 Years Before Your Retire

0 Comments

/

When it comes to retirement, common wisdom is to start planning early. Most people, however, are so busy making money in their 20s, 30s and 40s that they neglect to plan.

6 Places to Find College Scholarships

Trying to find a free scholarship that your child qualifies for can feel like looking for a needle in a haystack. Even if you do find some possibilities, understanding how to fill out the application can be challenging.

5 Ways to Teach Your College-Bound Child Financial Wisdom

Help your child figure out what income there will be (money from home, financial aid, a part-time job) and when it will be coming in (at the beginning of each semester, once a month, or every week).

Discover how “What if Planning” Might Protect and Improve Your Financial Future

Most people walk around with “What if?” questions in their head from time to time. Some of them are fun scenarios, like “What if I want to retire 10 years earlier than planned?”

How to Avoid Paying Taxes During the Retirement Withdrawal Phase

Many retirees overlook the cold hard reality that taxes will have to be paid on never before taxed income.

Don’t Settle for Less. How to Maximize Your Portfolio by Avoiding Taxes at Withdrawal

Learn about a simple and safe, investment vehicle that will provide you with tax-free income after retirement.

5 High Net Worth Retirement Planning Mistakes…and How to Avoid Them

Wealthy individuals may have a lot of money, but they often lack control over where it is invested – and this can cost them in the long-term.

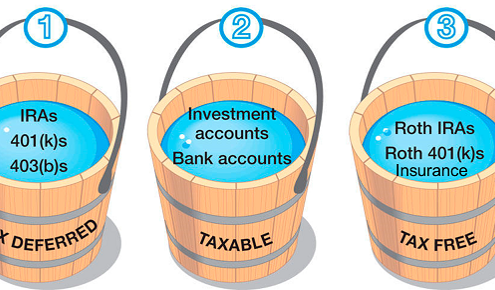

Tax Now, Tax Later or Tax Never? Which one will help you reach your retirement goals?

How to avoid a high tax bill when you withdraw money in retirement.

Maxing out retirement contributions? Do you understand the taxation when you take withdrawals?

There are huge tax consequence retirees end up paying each year on withdrawals, because people are taxed at their highest tax bracket in retirement.

Is 4.0% average growth enough to power your retirement?

Do you know how much money you’ll need to retire comfortably?