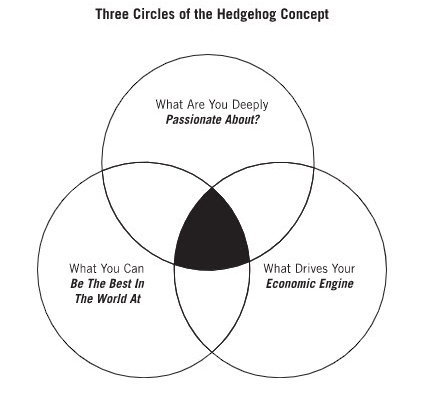

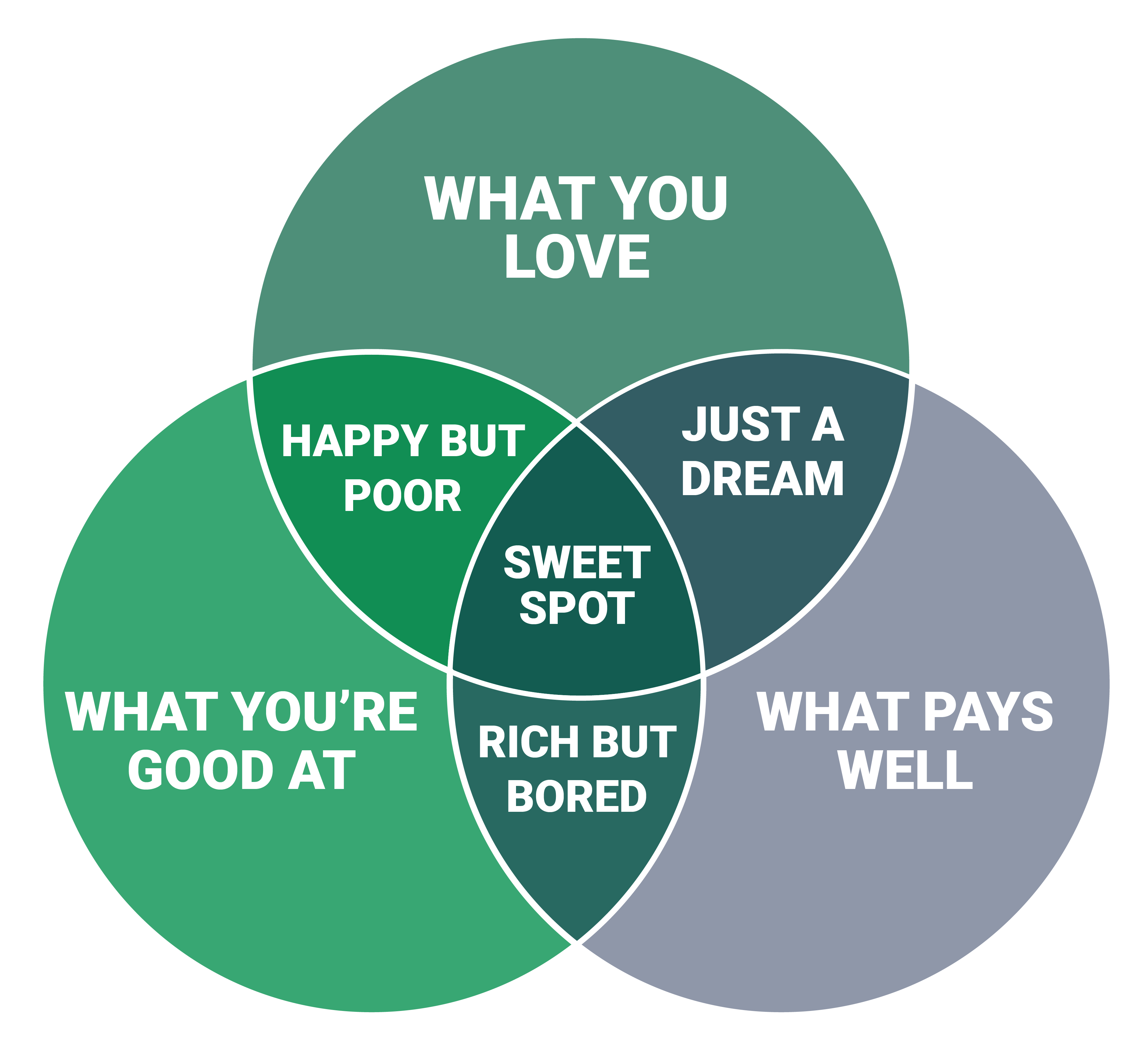

Somewhere around 2005 or so I was introduced to the image above, The Hedgehog Concept. It comes from the book “Good to Great” by Jim Collins. When I first saw it, and it was explained to me, it did not make sense. The wording was a bit too business oriented and I had trouble with the economic engine term and the best in the world idea! It was just too large for me to wrap by head around.

Since my first exposure to this diagram, and the concepts that drive it, I participated in my first class based on the book “If Your Life Were a Business, Would You Invest In It?, John Eckblad and David Kiel, McGraw Hill.

The class, gave me to ground work to turn this image into a guiding force in my life. Discover the things you are passionate about, things you are skillful in, things for which you can well compensated. Engage in these activities as frequently as possible (The hedgehog above, or your sweet spot) and at the same time eliminate activities that do not fit!!! It really is quite simple in concept. It can be a bit more complex in execution. (More on that later in my next article)

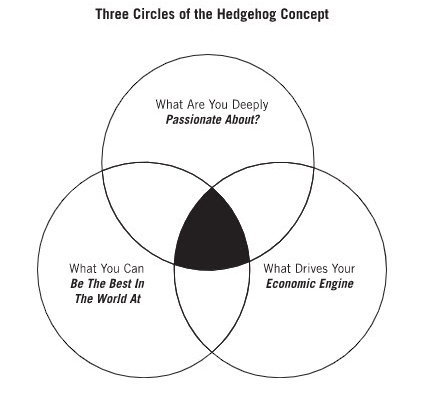

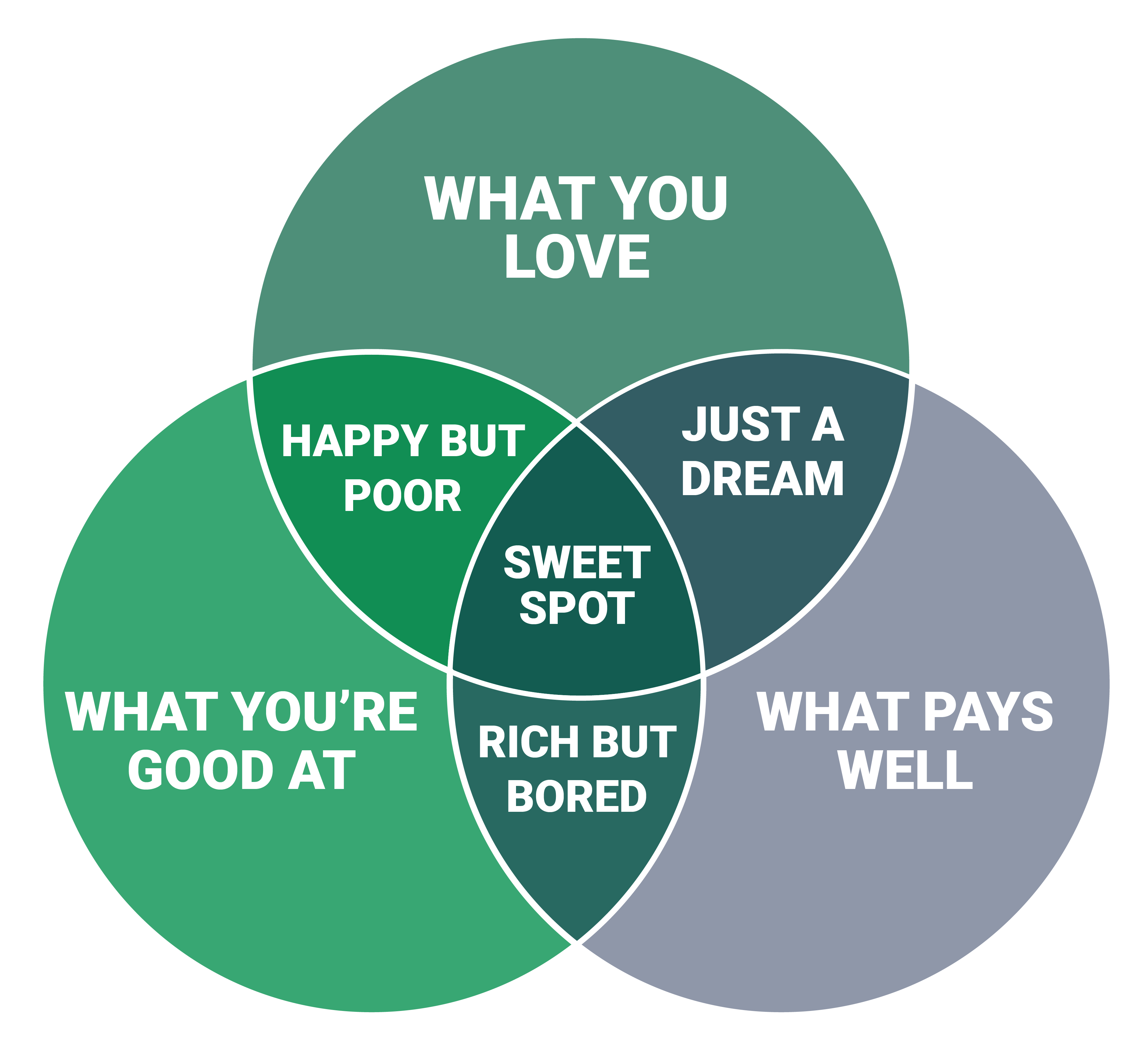

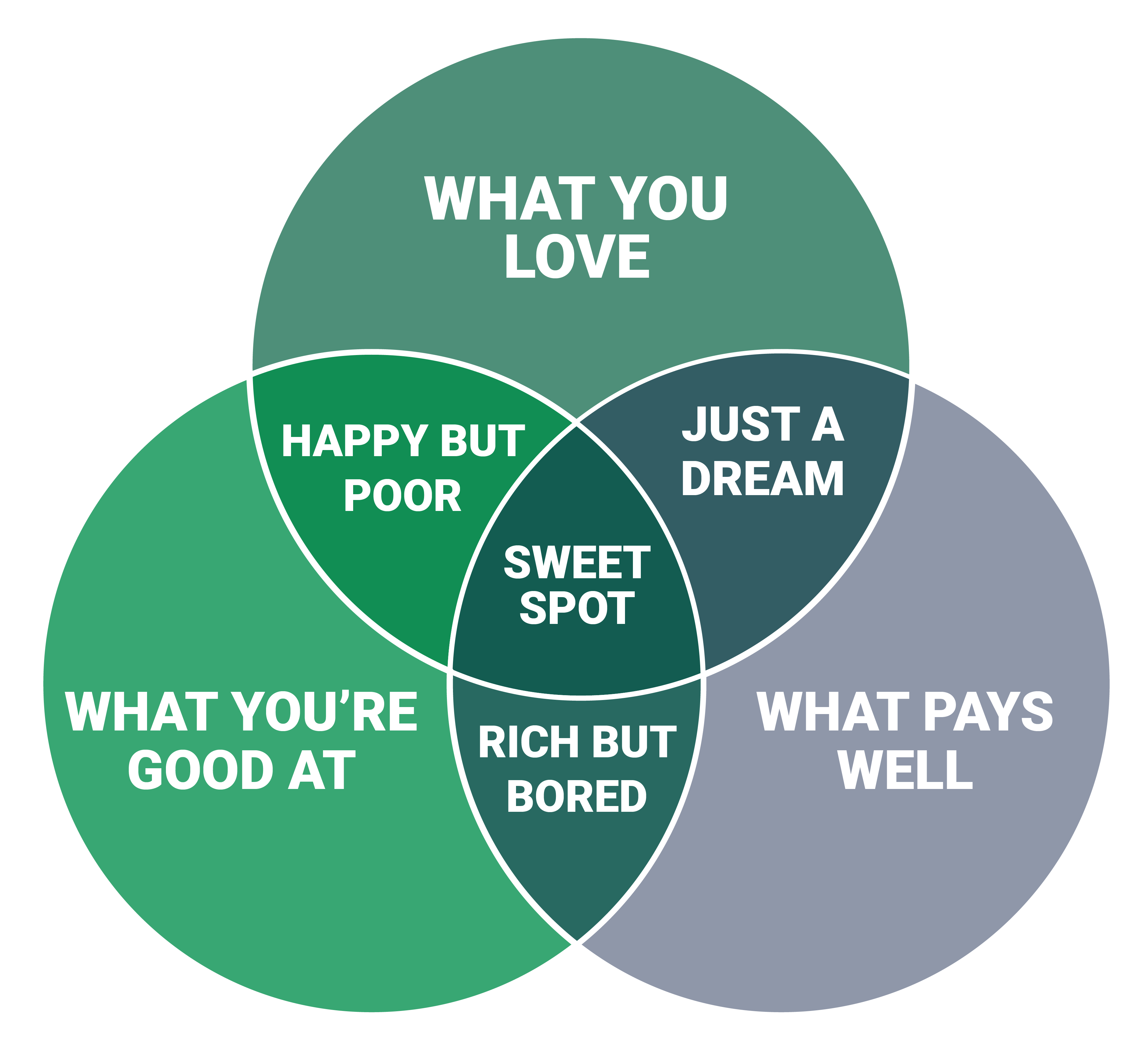

Now, with a bit of revision, this alternative visual makes a bit more sense to me:

For me this began as a realization that I love to teach, I love to help others simplify their lives and create more satisfaction in their daily activities. For many people, making these changes involves dealing with some “financial reality”! Often the first thought that comes after the realization of “your sweet spot” is “How on earth can I do that ?!?” “How can I support myself, or my family, if I attempt to make these changes ?”

This can be where having the support of a person who has:

• Accomplished this himself,

• Successfully coached people in this way since 2007,

• Practicing Financial Advisor since 1994.

could be helpful in guiding you along this path!

For me, the gradual shift came as I realized I was most satisfied working with clients who wanted assistance in shaping their lives in this way, and wanted help with the financial planning work to support these changes.

As I slowly shifted my practice in this direction:

- I reduced my business size from roughly 500 households (clients) to 100,

- At the same time just about doubled my income.

- I was living in my sweet spot!

- Enjoying the work I was engaged in to the fullest,

- had eliminated or delegate mostly all of the work I did not enjoy or did not need to do,

- and reduced my work week from roughly 70 hours a week to under 30.

Now I have created time to teach, coach, set up a wood working shop in my home, walk my dog Lambchop in the early mornings in the woods behind our house (this is when I come up with my best ideas), and enjoy my life to its fullest.

If you would like to explore creating some of these results for yourself, feel free to use my online schedule to set a time for us to talk.

Jerry Bergner is a productivity and life satisfaction coach. His company is Integrated Life and Financial Planning. Jerry has been coaching since 2008. His sweet spot is working with business owners and salespeople to assist them in focusing on the activities they enjoy and love to engage in while increasing their results and overall satisfaction at the same time. Contact Jerry to book a consultative strategy session to learn how he can help you work toward your goals.